Excitement About Offshore Company Management

Wiki Article

More About Offshore Company Management

Table of ContentsThe Main Principles Of Offshore Company Management Rumored Buzz on Offshore Company ManagementThe 7-Minute Rule for Offshore Company ManagementOffshore Company Management Things To Know Before You BuyOffshore Company Management for Dummies

Tax obligations vary greatly from nation to nation so it is essential to make sure what your tax commitments are prior to picking a territory. Tax obligation obligations usually are determined by the nation where you have long-term residency in and as an useful owner of a firm you would certainly be reliant be taxed in your nation of home.Protecting your assets with an overseas framework, whether that's an LLC, Trust or Structure, makes it a lot more challenging to link you to your possessions. Whenever you have an investment or properties, it is essential that they stay unique from your person; this ensures that they will not be reliant any one of the financial debts that you incur as an individual.

An offshore business separates you from the company entity and because the overseas framework lies in an abroad jurisdiction there is a different lawful system as well as collection of laws that assist protect the firm must it become targeted in any type of property search or lawsuit. A lot of international overseas nations do not respect regional court orders unless there is a criminal examination with significant evidence of misbehavior in order to break right into properties of an offshore structure.

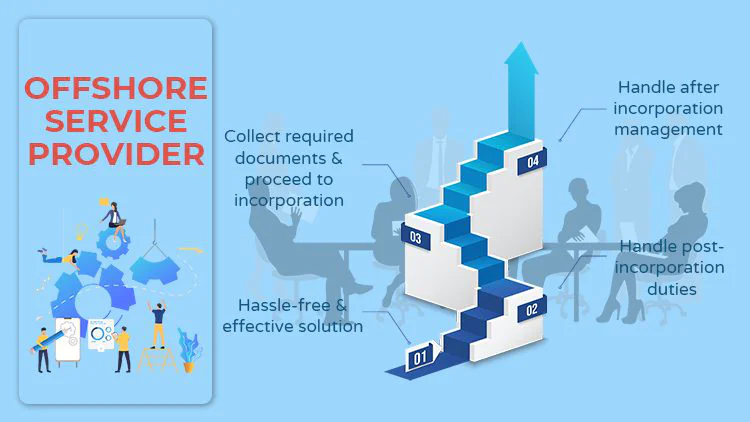

We perform our organization considering that 2006 and we have a worldwide network of representatives and also experts of the as well as. Our consulting business will certainly care for gathering appropriate and also useful information for your overseas firm project. We will deal with all the consolidation treatments of your overseas firm in more than twenty jurisdictions worldwide.

Offshore Company Management Things To Know Before You Get This

We will evaluate your documents and we will explain the very best method just how to make a solid offshore unification to enable you to deal with self-confidence. We will certainly submit you a comprehensive quotation validating our statements. We will certainly wage the development of the offshore firm as well as opening of offshore savings account.

Theoretically, offshore holding business can function as a single firm supplying services or marketing products. In technique, offshore holding acts as a "moms and dad" to different firms that it handles. The production of offshore firm found in a tax obligation sanctuary allows exception from tax obligations, by making substantial use international tax obligation treaties - offshore company management.

The offshore territory of Dubai, in the United Arab Emirates, is a preferred and expanding offshore jurisdiction; great ton of money of the globe and also capital circulation there. Creating your company, or perhaps relocating it to the city of Dubai is now a pattern. Nowadays there is a substantial increase in the amount of.

What Does Offshore Company Management Do?

In situation of non renewal of your company, we should close the offshore checking account held by your business and also strike off your overseas business. The expense of these procedures is your obligation. The expenses of these operations vary according to plans placed in location as well as are offered on request.Hong Kong allows you could try this out creation of offshore companies and offshore checking account if your firm does not sell Hong Kong area. Additionally, in this situation, there will be no corporate tax used on your revenues. Offshore business in Hong Kong are attractive: secure territory with exceptional track record as well as a reputable offshore financial system.

Offshore spending therefore becomes an insurance coverage plan. This is the greatest driving force for the majority of financiers. Must not be the primary driving factor to hold properties offshore. The index tax financial savings stemming from offshore financial investments are not unlawful, they are part of a well planed global investment framework. They are a product of geo arbitrage, had fun with taxation regulations among various jurisdictions.

Possessions are easily branched out in these jurisdictions as a result of the very easy accessibility to global markets as well as exchanges. Normally, a jurisdiction with the least limiting guidelines will be chosen by capitalists. In an overseas setup, a company can grow faster and also more rewarding by making use of these jurisdictions. A lot of overseas jurisdictions supply foreign financiers a level of privacy.

Offshore Company Management Fundamentals Explained

Hiring specialist economic experts will conserve you a great deal of time establishing up and also handling your overseas accounts. For some financiers, specifically those new to the overseas world, the concern whether this principle is safe or not is of problem.

Hong Kong allows production of offshore business and also overseas checking account if your company does not trade in Hong Kong region. In this situation, there will certainly be no corporate tax applied on your earnings. Offshore firms in Hong Kong are appealing: secure territory with superb track record and also a reputable overseas banking system.

Offshore spending hence comes to be an insurance policy. The tax obligation cost savings acquiring from offshore financial investments are not illegal, they are component of a well planed worldwide financial investment structure.

The Basic Principles Of Offshore Company Management

In an offshore helpful site setting, an organization can grow faster as well as more lucrative by making use of these territories. A lot of offshore territories supply foreign investors a degree of secrecy.

This privacy does not always indicate that international financiers are seeking illegal movements on an international range as well as does not automatically suggest that offshore territories encourage prohibited tasks, it is merely bring back a right that capitalists have lost in the majority of first globe countries. The confidentiality regulations maybe breached in clear circumstances of criminal acts by the investor.

Employing expert economic experts will save you a lot of time setting up as well as managing your offshore accounts. For some capitalists, particularly those brand-new to the offshore globe, the question whether this idea is safe or not is of worry.

Report this wiki page